- Home

- Investing

- How we invest

- Implementation

Implementation

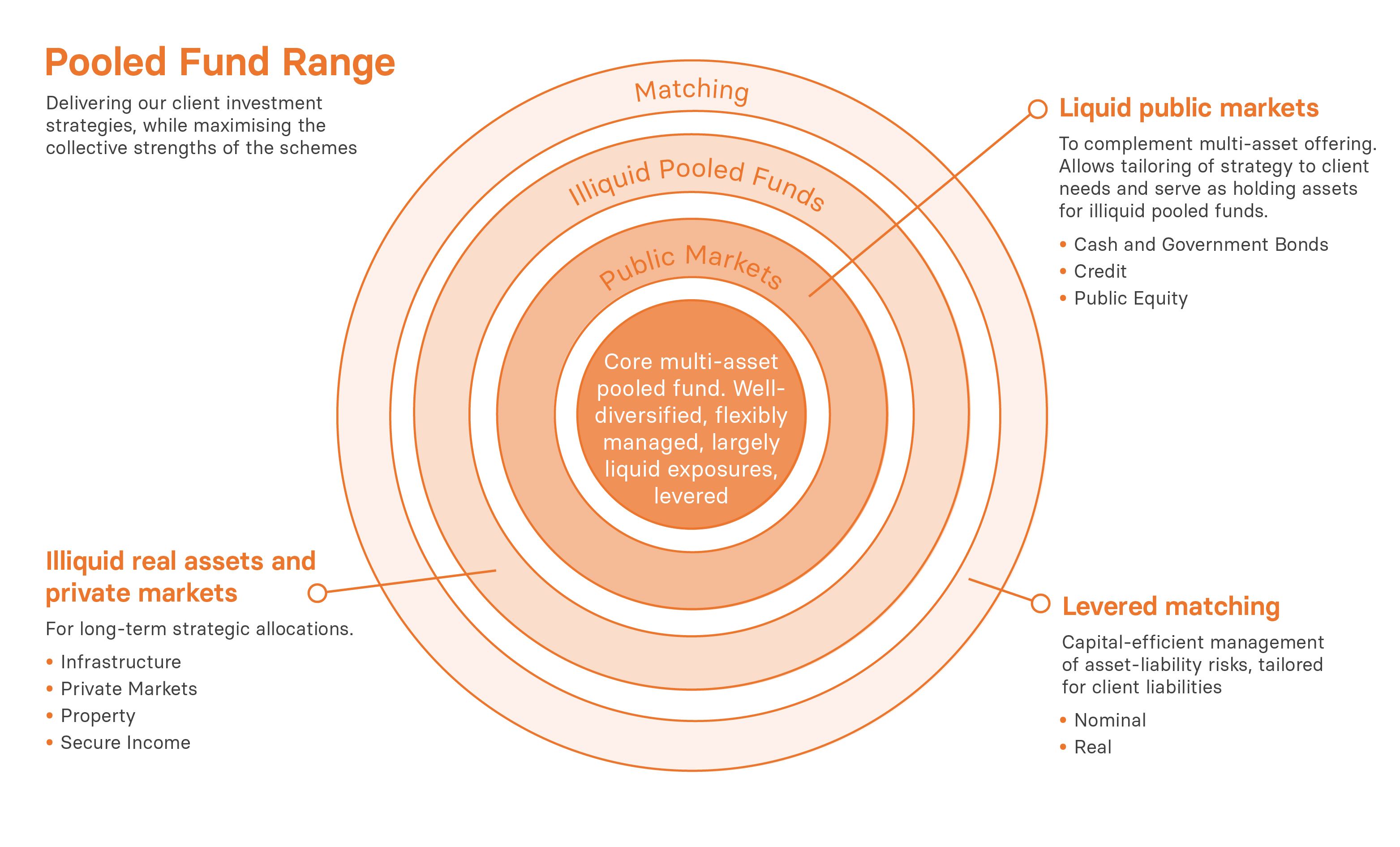

Maximising collective strength, supporting individual client needs

Delivering our client investment strategies

Our collaborative relationships with our clients flow from our investment beliefs and continue into implementation and beyond - recognising that situations and needs change, and an element of flexibility can often add value.

When considering the structure and mandates for how a client's assets are invested in line with the strategy we shape with them, we apply a number of criteria that have been established with the Trustee:

- The ability to tailor investment strategies to a range of different section needs.

- The need to efficiently exploit the collective advantages of the schemes.

- To ensure we provide sufficient coverage of the asset universe.

- That we support a robust investment risk management process.

- That our key performance indicators are aligned to sections’ success and risk outcomes.

Client assets are invested into co-mingled and unitised pooled funds. This allows us to exploit the collective advantages of the schemes - scale and stability of assets, time horizon, liquidity and cashflow profile.

However, we try to maintain the smallest number of pooled funds possible that allow us to tailor exposures to client needs while continuing to capitalise on the collective advantages.

| Investment Belief |

| Investments should be selected, structured and sized in a manner aligned to a scheme's long-term objective. |

The majority of client assets are invested using a multi-asset approach which can be across groups of assets, such as private markets and secure income, or more broadly across many different types of assets.

Railpen’s multi-asset approach focuses on the desired risk-return characteristics needed in different elements of the strategy, rather than being overly precise at a granular level.

This approach enables us to allocate capital to opportunities in good time, without compromising our client's overall investment and funding strategy.

It ensures “good assets find a home”.

| Investment Belief |

| Effective portfolio management requires flexibility around a thoughtfully considered investment strategy. |

Railpen's ability to be flexible in implementation demonstrates the importance we place on ensuring that investment decisions are aligned to our client’s long-term objectives.

Our integrated risk governance and management processes promote collaborative, client-aligned behaviours with an appropriate amount of independence to ensure the client’s voice is heard in investment decision making.

Mandates are generally focused on the required investment risk profile and long-term returns needed, rather than on beating a benchmark.

@railpen

@railpen

/railpen

/railpen